Most advancements are paid back again on the next payday. For those who’re battling to make finishes meet, lowering your following paycheck to have dollars now is probably not an excellent Alternative.

A financial loan is yet another way to borrow money from your employer. As with a payroll progress, just one perk is that the employer could possibly be willing to aid even when your credit rating is poor.

Your Rewards Examining Moreover account should be open and in fantastic standing and you need to be recent on all personal loan(s) via Update (which include, for avoidance of question, any automobile refinance bank loan(s)) to receive a bonus. Joint bank loan programs usually do not qualify to the welcome bonus. Welcome bonus gives can't be blended, substituted, or applied retroactively. The bonus might be placed on your Benefits Examining In addition account to be a a person-time payout in sixty times of meeting the problems. Approval of your financial loan is just not certain which is issue to our verification and evaluate system.

3% hard cash back is restricted to as much as $50 each year and applies only to buys designed at U.S. Walmart locations and on Walmart.com. This promotion may not be coupled with other Just one promotions offering hard cash back on buys at Walmart. Phrases Implement.

Salary advance loans will also be short-term borrowing answers. Most paycheck progress loans are repaid on your own following payday. This implies the full amount of advance pay— as well as any interest and fees — will occur out within your following paycheck.

Get in the driving force’s seat and receives a commission! Uber has the biggest community of Energetic riders … and that means more means so that you can make money.

We provide secure cell banking that permits you to conveniently regulate your account from creating deposits, to sending money or paying costs.

Most paycheck advance applications don’t charge fascination or late costs in case you don’t spend again the money you borrowed. But you usually won’t be able to borrow extra money right up until you make your repayment. Occasionally, you could be banned from an app for those who continue to not pay back back money you borrowed.

A wage advance is a mortgage that lets you borrow money from your long run paycheck. In essence, you get your income ahead of time.

Empower gives Income Advance, which can offer from $ten to $250 quickly,1112 without any interest or late fees, to assist you get by. Empower will Examine your account history, account exercise, and direct deposit details to determine irrespective of whether you qualify for Dollars Advance. For those who qualify and wish Money Advance, just request it in the cell app (readily available for both of those iOS and Android gadgets). Empower can deposit money into your account for your personal fast use.

This may possibly audio like a payday loan. Some payday lenders even advertise their solutions as “payday advances.” Even so, payday financial loans and income advances aren't the exact same.

Attorneys that get reviews from their peers, although not a ample selection to determine a Martindale-Hubbell Peer Critique Ranking, could have All those opinions Display screen on our Sites.

Chronically using paycheck developments or payday loans is an easy method of getting trapped in a cycle of personal debt. You might think you only have to have a little bit income right until the subsequent payday, but what transpires when it’s time and energy to repay? You could possibly end up taking yet another loan to receive by. It’s just not sustainable.

Most of these financial loans may perhaps consist of installment financial loans or money from payday lenders. Probably safer alternatives contain paycheck progress more info applications and credit builder financial loans.

Jennifer Grey Then & Now!

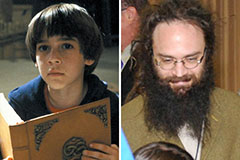

Jennifer Grey Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!